A very warm welcome to all the new subscribers. I’m thrilled to have you as readers and truly appreciate your feedback and support.

In this week’s SPN:

Market growth: Turn vanishing media dollars into an advantage

How to supercharge Major Donor Fundraising via individual giving

Jobs & Opps that caught my eye this week

Let’s dig in!

How about achieving even greater visibility into your Orgs campaign performance and donor behavior?

Designed to empower data-driven decision making and maximize your ROI, Fundraise Up launches its enhanced Insights Dashboard tomorrow, April 1.

It’ll be no surprise to current customers that the design is intuitive and frankly, gorgeous. Not a customer yet? Maybe now’s the time to take a test drive.

Game changer? It was for me.

Turn Vanishing Dollars into an Advantage

Growing the total addressable market of donors is what matters most - market growth. One significant way we can achieve that is by more smartly and efficiently leveraging our paid media investments.

SPN #92 made some practical recommendations inspired by the ANA’s recent exposé of the billions in media dollars wasted in their Programmatic Media Supply Chain Transparency Study.

But some conversations with smart SPN readers this week convinced me that it really isn’t all doom and gloom. Another way to read the results is to see there’s $22billion up for grabs in extra media productivity.

For context, that’s $3billion more than the GDP of Albania. All it’ll take for you to realize your fair share of that is a full view of your supply chain that delivers your impressions to the marketplace. But that feels like a big “all”.

Practically speaking, you need to claw those dollars back from unproductive media and reinvest them in viewable, measurable media that deliver wholesome experiences for donors.

3 Routes to Uncover Unproductive Media

Monitor ad viewability. Utilize tools like MOAT and Google Active View to measure the viewability of ads. Ads that aren’t seen by users (e.g., because they’re placed below the fold or on unvisited pages) are obviously unproductive and wasted spend. Also, consider frequency - not necessarily a bad thing but it does need to be pitched at the right level.

Ask how data is collected. Explore how data is shared and used throughout your media buying process. There are no dumb questions. Lack of transparency in data usage leads to inefficiencies and missed opportunities for optimization.

Cross-Channel integration. Move away from single-channel activity. Seek opportunities for synergy. Push for channel integrations in your media and marketing planning, and among your agencies.

Expectation of Value

By making efforts to implement the above, you’ll also help the digital ecosystem by better signaling your expectation of value in programmatic and your unwillingness to reward those ad vendors who fail to deliver to that standard.

It seems P&G’s chief marketing guru Mark Pritchard agrees - he shared their new approach to Media recently, focusing on Reach, Effectiveness, Efficiency and Integration.

There’s a lot of common sense in his strategy announcement and Pritchard has clout, so hopefully his thinking will be given an extra boost. Two very interesting things I noticed in what he wrote - his endorsement of in-house media and one of his calls to action:

Step up to eliminate wasteful touches and costs in the programmatic supply chain, and avoid excess frequency through cross-media measurement.

Competitive Advantage

The waste in programmatic is an opportunity for Org’s to take the competitive advantage. Your agencies should be coming to you saying “you can have 20% - 30% of your budget back since we’ve clawed that media back out of the trash or we can go re-invest the savings and drive some incremental dollars”. If they’re not, I for one would be asking why not.

Jobs & Opps 🛠️

United States Bartenders’ Guild: Executive Director ($165,000 - $205,000)

National Geographic: Director, Strategic Communications ($133,000 - $158,000)

Goodwill of Colorado: Director, Ecommerce ($110,000 - $120,000)

World Food Program: Chief Digital Architecture - Rome, Italy (Band P5)

UN Peacekeeping, Digital Enablement Team (DET): Digital Transformation Programme Officer (Band P3)

National Resources Defense Council (NRDC): Chief Program Officer ($350,000 - $400,000)

National Trust for Historic Preservation: Senior Director, Social Impact & Marketing ($135,000 - $145,000)

National Audubon Society: Director, Digital Content ($125,000-$160,000)

Doctors Without Borders/Médecins Sans Frontières (USA): Senior Data Scientist ($88,822 - $111,027)

J. Paul Getty Trust: VP Comms and Community Engagement

United Nations Foundation: Director, Content and Engagement Strategy, Better World Campaign ($98,000 - $128,000)

Supercharge Your Major Donor Program

Most nonprofits I’ve spoken to since SPN’s inception closely resemble the following Org chart:

Despite the diverse sizes, specific tactics, and potential focus on corporate partnerships or grant-making, a common trait often emerges - a distinct barrier between the Retail/Mass-Market and Major Donor teams.

And yet it’s not uncommon for the Legacy team to receive a significant check from an estate executor of someone never considered a Major Donor. As it turns out, they were flying under the radar in the “retail donor” bucket – while likely giving substantial amounts away to other Orgs.

The above is clearly a missed opportunity. I don’t think the answer is to integrate the teams - the economics, ROI benchmarks, and acceptable cost per touch vastly differ between the two worlds. And most Orgs wouldn’t risk changing the setup that’s working either.

However, there seem under-explored opportunities for mass market fundraisers to help supercharge the Major program.

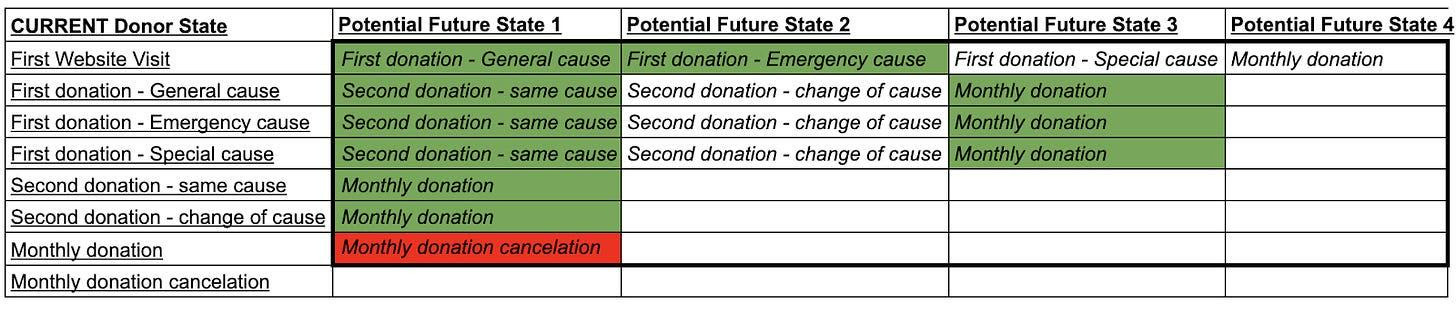

Major Giving is another step in the donor Lifecycle. Here’s that lifecycle image I first shared back in SPN #27, which doesn’t include a shout-out to Major. Although the image suggests otherwise, a donor lifecycle doesn’t have to end with a Monthly donation - some of these donors will inevitably contribute major amounts.

And there’s no way of knowing upfront who exactly that will be. I’ve been told too many memorable stories about old ladies who walk into Park Ave. stores wearing a moth-eaten coat who then drop vast sums of money on the latest “it” bag to judge books by their covers anymore! You really just don’t know.

Recommendation: Everybody should be afforded as close to Rolls Royce levels of attention and service from the get-go as possible. Amp up your level of donor support and understanding of “experience” regardless if donors give you $10. Embrace them! Create a personalized Thank You sequence to be sent right after the first donation, have your ceo drop them a random thank you call, send a personalized video (AI can help create them at scale, even adding things like your Orgs ceo avatar), and show them their impact irrespective of donation amount. Make it memorable.

The main difference between Retail and Major donors is their Capacity to Give, which is different from Likelihood to Give.

“Likelihood to Give” is a comparative metric that reflects the donor’s potential connection to your organization versus any other. It’s the essence of Look-a-Like audience modeling - target donors that are more likely than the general population to donate to your Org.

In economic terms, Likelihood to Give measures whether a person is willing to contribute a certain percentage of their means to your Org. It’s a vital metric - marketers use it every day, knowingly and unknowingly. But it doesn’t help identify potential Major Donors.

On the other hand, “Capacity to Give” measures the scale of a donor’s ability to donate aka the size of their wallet. The ideal major donor might have the same Likelihood to Give as a monthly donor but a much larger Capacity to Give.

Capacity to Give also can’t be measured by examining only the donor’s behavior in ad buying or using web analytics tools available to your Org - it requires enriching the donor profile with income, net worth, and other signals.

Recommendation: A very small percentage of donors originating from the Retail fundraising program have the means to become Major donors. And with those who do it takes considerable effort - the cost per touch is very high in the Major Donor world, with personalized 1:1 communication and in-person visits. One role of Retail fundraisers is to identify who they should pass along to their Major Donor counterparts. But that information won’t live in your CRM system and requires some Enrichment.

I touched on how to measure Capacity to Give in SPN #41 - the best source is data from credit agencies, such as Experian, which includes income, net worth (primary indicator), credit score, etc. It’s important to regularly refresh this data too - at least once every year, especially since Millennials - most of whom are likely in the Retail bucket right now - are getting wealthier by the minute, as we discussed in SPN #90.

Find the basis for a Similarity Score of sorts. Having the Capacity to Give data for active retail donors isn’t enough to identify those who can become major donors. Take one more step - and compare the dataset to existing, active major donors.

If your Org has a CDP it most likely has built-in functionality to do so. But even without a CDP, most media buying tools have the so-called “audience similarity” report to compare your current donors to potential third-party audiences. Unfortunately, Google Ads doesn’t have this functionality, but enterprise-level DSPs do.

Recommendation: Get your hands on the Major Donor file from the Major Giving Team. Create several versions of the Retail Donor file with different Net Worth ranges. Tier it into 20 files, each including 5% of the total donor count. Upload both the Major Donor and resulting Retail Donor files to your media buying platform - or supply them to your Media agency - and run the audience similarity report to identify which ranges of Net Worth are most similar to your existing major donors. These reports aren’t ideally accurate, so seek a similarity score of 80%+.

Look into donor engagement history. The Retail program is a treasure trove for understanding these donors and informing future comms for the major fundraising team. What creative assets did they interact with the most on their journey to becoming monthly? Website pages? Emails? And so on. These bits of information are only available in the media buying tools or website analytics platform - and the Retail Fundraising team is the only one with access to them.

Recommendation: Put a standing meeting on the calendar with the Major Giving team to regularly review current or potential Major Donors’ engagement with marketing content and assets.

Report on total donor LTV. Converting current irregular and monthly retail donors into major donors is a long shot, but when it happens, the impact is profound. Most Orgs separate Major and Retail donors in their reports - but it’s in the interest of the Retail fundraising team to track whether any donors ended up significantly increasing their contributions.

Recommendation: Run an annual report of the total value of donors originating from the Retail fundraising program out of the CRM, regardless of which bucket those donors currently fall into. It can significantly increase the program’s reported ROI, helping to find a common language with the CFO.

Close the loop. Retail and Major fundraising relationship is a two-way street. Two examples of how the Major Donor data should be used in Retail fundraising:

a) Increase bids on prospects who look similar to both Retail and Major donors. In your prospecting efforts, create an extra campaign that combines the look-a-likes of both retail and major donors. That overlap will be small, but for the people who fit both criteria, increasing bids even 2x is worth it. This will increase the Average Donation Value and, ultimately, ROI.

b) Amplify the retention effort for monthly donors that look like Major donors. Similarly, include the Major Donor look-a-like as targeting criteria in your retention campaigns and increase bids at least 2x to prevent this subset from churning.

Wrapping Up

Anyway, that was fun to explore. There’s definitely a sizeable opportunity for Orgs to optimize their integration efforts - at the channel and paid media level as called out in the 1st post and then in this 2nd post, where Org structure calls for a divide of sorts between two teams, which likely overlooks the dynamic nature of donor engagement and giving.

Hopefully viewing the donor lifecycle as a continuum rather than a series of discrete segments will help your Retail and Major Giving teams connect more deeply, and foster a more bi-directional sync of sorts that can supercharge donor transitions into your Major giving circle.

That’s all for today!

If you enjoyed this, please consider sharing with your network. Thank you to those that do. If a friend sent you this, get the next newsletter by signing up.

And huge thanks to this Quarter’s sponsor Fundraise Up for creating a new standard for online giving.

Now onto the interesting stuff!

Reads From My Week

Google.org launches program to help fund nonprofits developing tech that leverages generative AI (Tech Crunch)

Augmented Marketing in Beauty with Generative AI (Diginomica)

Spotify To Test Offering Online Courses (The Verge)

DV360 Accepts The IAB’s New Video Guidelines (AdExchanger)

Brands add AI restrictions to agency contracts - behind the growing trend (Ad Age)

Martin Sorrell Was the Ad Industry’s Hunter. Now, he’s the prey (WSJ)

How we are using AI for reliable flood forecasting at a global scale (Google)

2024 Digital Media Trends (Deloitte Insights)

PepsiCo To Stop Advertising On Linear TV - a story from Australia - but global implications? (BandT)