Happy Sunday. On paper I’m one year older (since yesterday) and feeling very spoilt. Thanks for all your feedback and support on this adventure of Some Personal News. I’m thrilled to have you as readers. And a very warm welcome to all the new subscribers.

In this post I’ll cover:

Adtech + Agencies and org design

Taxonomy Matters

How to Unlock New Performance Max Insights

If you find this newsletter’s content interesting, please forward to industry friends. If you were forwarded this email, join our community by clicking below:

Let’s dig in.

Adtech Thoughts - Meta and the Evolving Value-Add of Agencies

Meta is re-finding success with its ad products and getting close to the levels of performance before Apple went nuclear with privacy. Using AI and its own 1st party data, Facebook has replaced targeting users based on gleaned interests and instead is creating multiple ads to see what works.

I’ve heard fears of being forced to relinquish too much control to the platform. But others are seeing great success. I read an estimate that the revenue earned for each dollar spent on advertising is 20-30% higher on Advantage+ than other campaigns on Meta not run through this tool. Pretty much out of the gate, those campaigns are starting to outperform any business-as-usual campaigns. What are you seeing?

Clearly Meta has the opportunity to use the latest developments in AI to keep improving performance. And they’re also taking Marketing Mix Models very seriously as this good thread shows.

Separately, ISBA seems to be returning to the opaque word of “programmatic” and it’s triggered some interesting conversations. I read the latest ISBA paper this week and am wrestling with where agencies have the opportunity to step up. I see huge value-add in their technical support when it comes to better visibility of how budgets are allocated, and spend and fees across all partners and vendors, as well as analyzing data.

With the move from cookies to a reliance on first-party data modeling, we all want access to data to optimize campaigns and improve performance… but the reality is few organizations really have the skills inhouse needed to deal with the complexity of data analysis required.

Understanding the role agencies have and can have - especially as operators talk up inhousing and think about organizational design - is crucial. Whilst inhousing isn’t that practical (horses for courses, depends on lots of factors), orgs can take much more control by employing specialists rather than a generalist Agency.

Bonus thought: a good BI story on one time adtech giant Mediamath highlights the danger of underestimating agencies. The Trade Desk focused on partnering with Agencies whilst Mediamath sought to disintermediate them by going direct to brands.

Just one of those firms is now a Wall Street success story.

Taxonomy and Why it Matters

As our digital campaigns become more complex and more channels are added to the mix (e.g., YouTube Shorts and Bing that we discussed last week), the problem most operators run into is how to keep it all “manageable”. With resource constraints, the time you dedicate to reporting and optimizations is limited.

Remembering the details of 5 ad groups or line items is much more realistic than 50, let alone 100+ across several different platforms, all with their specifics and – frequently – very different structures. Despite the black boxy nature of machine learning-operated campaigns, at least the “machine” can be doing the optimizing and it all just feels more straightforward. Right?

This is exactly what Google, Facebook, and others also “want” us to do. Throw them the keys, let them figure it out, rely on their recommendations, group it all together, and focus on the big picture and not those minor, un-important dimensions…

Some of you may be feeling this with your Performance Max by Google efforts, having no control over your advertising and where the ads are being shown.

Check out the post below that includes a FANTASTIC and very powerful resolution

Something needs to be fixed about losing control while gaining scale. I’ve seen how it almost always leads to deteriorating performance. There must be a better way! One helpful workaround I have is a “one report only” approach.

Say we’re building a Google Display Ads campaign that:

Targets your ex-donors and

Serves them with an ad showing the topic they donated to – hoping it gets them back to your website to donate again.

This campaign could fall into the “Lapsed donor moving to Active donor again” cell in our Donor Lifecycle journey. But here are some of the nuances we need to capture in our campaign set up and reporting:

It works better on Desktop than on Mobile; the CPA is 30% lower.

It works better on Thursday and Friday; the CPA is 10% lower than on other days.

It works better for Females versus Males; the CPA is 5% lower.

It works better for those who are also in the DIYers Affinity audience; the CPA is 7% lower than for other audiences.

The above information can be generated via several basic reports in Google Ads but the real question is what to do with this intel going forward. Several options are:

Enable the “Minimize CPA” bidding algorithm and let Google figure it all out.

Break the campaign into 16 options (4 dimensions of varying performance above, with 2 options each, resulting in 16 individual campaigns as 4power2).

Use “Bid Modifiers” available in Google Ads.

Option #1 above is the “simplest” for the marketer but leads to obstruction of performance insights over time – and, therefore, the lack of control I mentioned above. Option #3 is the worst since it still obstructs the insights (none of those bid modifiers will make sense in 2 months), but it also complicates the management of campaigns.

#2 is my winner. I may be a control freak but for good reason. I want complete control over where and how I spend the orgs money. But that also creates a beast of a setup unless the taxonomy becomes our friend. Here’s an example of the structure I’ve used:

This creates the following campaign string as one of the 16 options for the example above:

Lapsed|GDA|1stPartyAudience|F25-34|Desktop|MinCPA|DayOfWeek|InMarketAudience|Whitelist||

(I’m using the “|” symbol as the divider between those dimensions).

The best part of using the taxonomy above isn’t the fact that I can now generate 16 campaigns, assign them different budgets, and indeed be in control – but that I can now assess the performance of the program in just one report.

Google Ads has roughly 200 dimensions available in their reporting platform. Facebook has a comparable number. By unifying the taxonomy across all of them, I now have one report with a single dimension as “Campaign” (Ad Group, etc.) name, break those into several columns with the “Convert Text to Columns” function (selecting “|” as a delimiter), and have all the main insights right at my fingertips. And there you have the “one report only” approach. Someone should productize this.

This isn’t the sexy stuff. But tracking and measuring performance matters. Building solid foundations matters. As you design your best-in-class digital fundraising program to fit your organization, it’s easy to get caught up in chasing shiny objects (ehem Salesforce Marketing Cloud) or launching new channels and inventory types.

Complexity can help tighten the campaigns' focus – not vice versa. Setting the taxonomy right from the get-go will help make your reporting 100x more useful. It’ll give those new channels I explored last week the highest chance of success too.

Unlock New Performance Max Insights

Take back control and make better decisions.

I called out Performance Max above and last week I flagged it as an inventory type to explore. So we all have the same intel it’s a new goal-based campaign type that allows you to access all of Google Ads inventory from a single campaign.

Earlier this week I played with an amazing script that creates graphs and tables that visualize pMax spend on 3 networks: Shopping, Video, and ‘Other’.

“Other” is troubling, though.

A lot of Google Ads Specialists (tap your agency) use this script because it provides nice additional insights. However, it wasn’t complete and 100% trustworthy. Why? Because ‘Other’ consisted of Search and Display/Discovery data.

Well, that’s about to change. Some very talented folks dug deep into Google’s API and found a way to single out spend on the Search network.

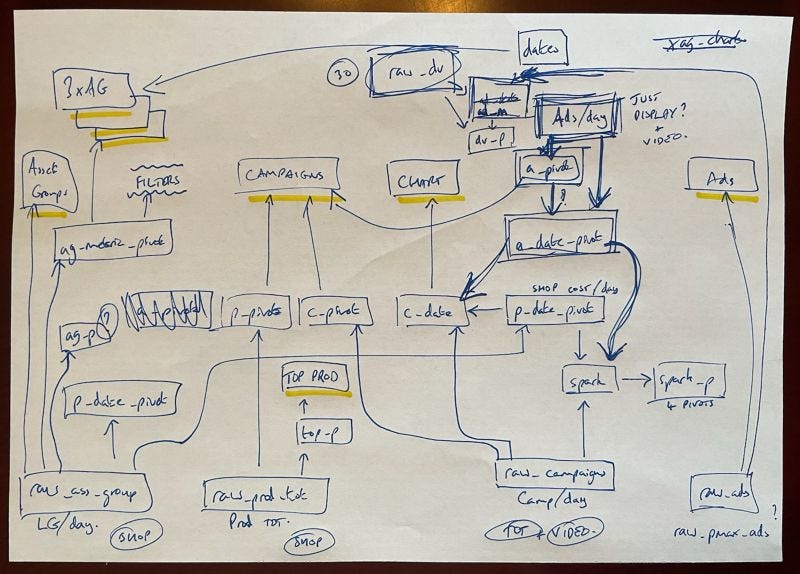

^ Very talented working out. I’m sure if the handwriting were better I’d totally understand it ;)

But I do understand the output and the benefit - with this unique development you can see where Google spent your pMax budget across Shopping, Video, Display, and Search.

The question’s got to be asked: if the data is available, why is Google making it so hard for us to access it?

So how do you actually use the script?

• Quickly identify trends (are you spending where you want to?).

• Create an action plan based on the insights.

• See if/how much pMax cannibalizes on your Search campaigns.

Set up the script in your accounts to take back insights and control

My advice:

• Set the script up

• Analyze the data at least once per week

• Take action fast based on the insights

Here’s the golden ticket:

Both account and MCC-level scripts are available here: https://github.com/agencysavvy/pmax/

Let me know how you get on.

Jobs & Opps

If you’re searching for a new role or contemplating a change, let me know how I can help you.

Care: Director of Digital Fundraising and Advertising

GiveDirectly: VP, Development

Human Rights First: Digital Director

International Justice Mission: Regional Lead Content Marketing (Canada)

National MS Society: VP Content Strategy

Sloan Kettering: Director, Social Media Strategy

Reads of My Week

Meta’s periodic transparency report.

YouTube’s new CEO Neal Mohan posted a blog outling his priorities - which are all about creators.

An interesting idea from the Economist - that Google should sell YouTube.

A recent benchmark report from Rival IQ found that TikTok’s median post engagement rate is much higher at 5.69% than other social platforms. (Compare that to 0.47% for Instagram and 0.035% for tweets).

WPP’s Mark Read on GenML in advertising.

Free ad-supported streaming (‘FAST’) is pretty big now - Fox’s Tubi has 64m MAUs.

Update on the US TV industry’s attempts to put together better metrics than Nielsen for streaming.

Thank you for reading Some Personal News

How can I help you? I use my experience, expertise and network to help mission-driven organizations solve interesting problems and grow.

If you find this content valuable, please share (I suck at self-promotion so could use your help). If you enjoyed this, please consider sharing with a friend.

See you next week.