Some Personal News

#36 (feat. Drake), making MarTech ROI-positive and exploring newTV opportunities

Happy Sunday. To those I spoke to or spent time with in-person - thank you. A very warm welcome to all the new subscribers. I’m thrilled to have you as readers and truly appreciate your feedback and support.

Let’s dig in.

AI - Integrating into Ad Creation

No sign of this space slowing down. The only thing to do is learn - through experimenting and reading. A good place to start is the New Yorker - asking What Kind of Mind Does ChatGPT Have?

Music is a really easy and obvious place to apply generative AI - there’s an abundance of training data, human feedback, a clear monetization strategy and error rates are controllable too. This week Universal Music Group (UMG) was instructing streaming platforms to prohibit AI companies from utilizing their data and a synthetic song using the voice of ‘Drake’, apparently a popular singer, is already going viral.

We may be close to seeing generative music produced by the “play more songs like this” command, especially in more common genres. Our current ideas of copyright don’t map well to this.

How is this applicable to Non-Profits?

Google are keen to regain momentum on AI - with their CEO showcasing BARD and demonstrating its capabilities. I had two (and was asked to attend a third which I declined citing Google overload) sessions with Google AM’s last week doing the rounds talking about how generative AI will be integrated into Google ad tools to create sophisticated ad campaigns.

According to their presentation and the ensuing media, non-profit advertisers can now supply them with “creative” content relating to a particular campaign - imagery, video and text - and the AI will then “remix” this material to generate ads based on the audience it aims to reach and your fundraising targets.

Facebook announced something similar.

The questions I’m wrestling with at the moment are:

How much more sophisticated are these tools? The AI and ML sitting inside Google Marketing Platform have been getting me one step closer to “relevance at scale” since at least 2017…

Who is driving their use?

What’s the role of an Agency if the platforms are doing all this work (and strategy should be housed internally)?

I placed some decent AI resources in the Reading section for further discovery.

How to Make Implementing New Tech ROI-Positive?

I’ve seen and consulted on numerous MarTech implementations, ranging from more standard and widely-used CRMs and DMPs to DAMs (Digital Asset Management) platforms, several CDPs, and niche tools such as Social Listening platforms or an enterprise-grade visualization tool.

More than half of the ones I’ve seen went wrong. They created significant extra workload for the organization and increased costs. They also produced little incremental revenue – if at all - since tracking was usually impossible.

While grouping the root causes, I’ve since landed on 3 themes:

Bad planning upfront. There are no clear objectives or definitions of success, no adoption (which is even more important than implementation), and no obvious way to cut losses early if plans go awry.

Letting the IT/Technology org figure it out. The CI/TO figurehead and their team are valuable stakeholders - but they should never be the only ones.

Falling for features, not for value. That’s how most of these tech tools are sold to us – shiny buttons and use cases but little details on recognizing their value.

With some battle scars under my belt, I’ve developed a framework to help marketing teams make successful MarTech additions. I thought it might be helpful if I shared it here. Each of the three topics deserves a post dedicated to opening them up even half-decently, so I’ll focus only on the first one and tackle others in another edition of SPN. I’ll also break it down further into Bad Objectives and Bad Resources planning.

1. Bad Objectives. Obvious, but let me say it – objectives should be tied to… Donor Lifecycle. No new MarTech tool should be implemented because of the discount offered or because your friend at a different organization already uses it. Most of the tech tools get you into multi-year subscriptions and 6-to-7-figure implementation costs that you can’t get out of once you sign the contract, so if there’s no clear need – don’t do it. Not even for the shiny case-study with the vendors brand logo slapped next to yours. It’s not worth it.

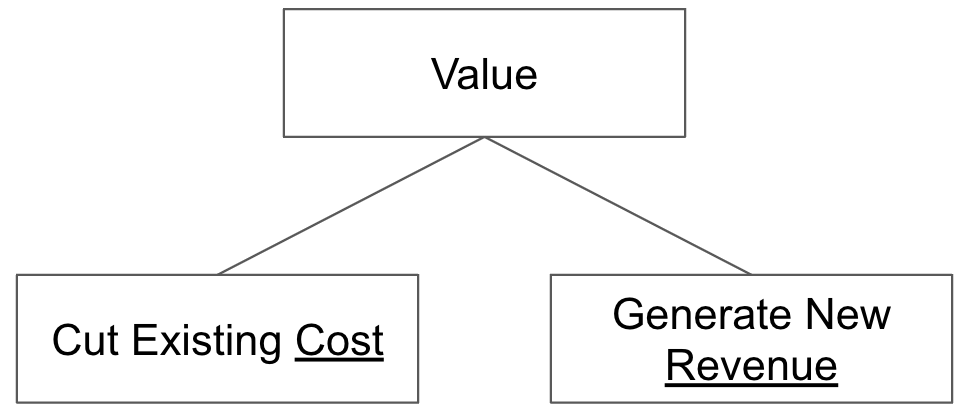

Objectives – ie, Value – can be of two types:

The cost in the diagram can mean either the marketing budget or the labor cost of your team executing a certain task/program. Unless you’re part of a large organization with 50+ people in Marketing/Fundraising, tech is unlikely to considerably cut your costs through automation (AI, we have high hopes for you). In most cases, it’s either about cutting marketing spending while maintaining the same result or growing the revenue generated by the same level of spend. Both of those are increasing ROAS use cases. And tying this to the Donor Lifecycle – they become Conversion Rate use cases since tech is unlikely to help you increase AOV, and those 2 constitute the ROAS.

So, my #1 rule is to identify the step of the Lifecycle where the CVR is currently the lowest and look for MarTech solutions that can help me address it. If your current CVR takes a hit for people converting from Cash Donors to Monthly, DMP is unlikely to help – while a CRM with strong marketing automation functionality can.

I usually set the target at 20% CVR improvement, maintaining the current volume of donors. So, if I currently have 100,000 new Cash donors monthly, converting to Monthly at 5% CVR with an average LTV of $150, that 20% improvement can help me generate 1,000 more Monthly donors per month. That’s $150,000, or $1,800,000 annually.

The $1,800,000 revenue gain is now my Objective.

2. Bad Resources. By resources, I mean all the Costs available to me. If my objective is to generate $1.8M in incremental revenue over a year (or $5.4M over 3 years – a “standard” length of any MarTech subscription), I want to do so with at least 2:1 ROI (per my CFO). That means my cost over 3 years cannot exceed $2.7M. That is the all-in cost – including the actual Tech cost, third-party implementation support, and labor cost of the team adopting the platform internally.

In my experience, the cost of any tool over 3 years looks like a 50%:35%:25% breakdown of the total – front-loaded to account for third-party implementation in the first year (20%) and ongoing support in the second year (15%). 25% in the third year represents a baseline – with 15% being the license cost and 10% for the internal team’s adoption that’s present every year thereafter.

50% for the first year is really 15% for the license, 10% for the internal team, and 25% for the third-party implementer. Applying it to our $2.7M 3-year cost limit, the total available to me for a first-year license and implementation services is only $1.08M.

In a scenario of aiming to increase the Cash to Monthly CVR, that “cost limit” is unlikely to get me a Ferrari - e.g. an SFMC-setup – so I’d need to consider other options, such as opting in for a partial tech scope or another tool altogether, for example, HubSpot.

Having the cost limit also helps in negotiations with vendors. Communicating your budget limit to them in advance cuts the crap of unnecessary feature-selling and gets straight to the point – which is exactly what you need. At this point, I would shop around and look for a tech vendor and a suggested implementation partner that can convince me the most of their ability to deliver.

It gets overly subjective, but I tend to lay my cards out on the table and tell “candidates” exactly what I need (20% CVR increase from Cash donors to Monthly for a maximum 1-year cost of $1.08M) – and then look for ways they propose to get there and the Value they’re expecting from it. The best MarTech sales pitch I ever got was from Adobe Analytics several years ago – they were the only ones who almost didn’t talk about their features, only stone-cold numbers. We didn’t buy the tool in the end, but I’ll credit them for trying!

The third element is Bad Processes Planning – that one gets into who should be a part of the implementation internally and why the Tech Team should never do it alone, so I’ll dig into that next time. NB the recap of Objectives and Resources below – and if you need specific advice for your situation, ping me directly!

newTV: An Opportunity for All Parties

In last week’s edition of SPN I mentioned that newTV was attracting more and more ad spend. But in the last quarter Netflix’s growth slowed dramatically - adding just 1.75M new subscribers - and profits fell by 18%.

Perhaps more interesting in their Q1 earnings report are the comments that ARPU (average revenue per user) amongst customers on the ad plan is higher than those on standard plans.

This growing recognition of the power of advertising suggests they’re going to look for more inventory. And that should be thought-provoking when thinking about where to place your advertising dollars.

The related chart from Nielsen is interesting as it shows how different the state of streaming is in mature markets versus emerging ones. But the chart is also a little deceptive - the UK figures do not include YouTube viewing.

Demand greater transparency and standardization for online video.

I’ve mentioned the tension between BARB (not to be confused with Google’s BARD above) and YouTube before, and that spat is heating up. According to BARB’s private allegations, YouTube's planning tools do not adhere to Media Rating Council (MRC) cross-media standards for online video impressions. The standards, which came into force four years ago, state that an ad is considered viewed if 100% of its pixels are on a user’s screen for two seconds. YouTube are dawdling.

A smart SPN reader recently suggested to me that the issue is really about what is television? YouTube claim 30M viewers but BARB says it’s closer to 17M - reduced because BARB only counts viewing of “fit-for-TV content.” Caveat emptor.

Don’t look at your metrics in a vacuum.

I read an insightful interview which outlines why Netflix’s nascent ad-supported tier is well-positioned to succeed despite its limited inventory. Interestingly, it won’t need huge commitments from brands. Rather just modest commitments from a number of them, and Netflix won’t need to trade pricing for volume like fully scaled players need to when budgets are under pressure.

The interview was skeptical about the adtech-driven focus on CTV though, suggesting it needs to dump the banner-born programmatic approaches for more natively-focused CTV platforms and approaches. The margins taken by programmatic platforms do seem pretty outrageous and I’ve shared many times in SPN that the lack of transparency is cheeky to say the least.

On the other side I’ve read people arguing that the open CTV ad exchange is about to democratize TV advertising, while accepting that big players will continue to trade through direct selling (PMPs etc).

I can see the market developing into these two buckets:

On the first page we’ll have the big players, offering a premium customer experience and taking most of the viewing and most of the ad revenue. Perfect for Netflix, Disney, Apple etc.

On subsequent pages we’ll have a plethora of FAST channels (like Fox’s TUBI or NBC’s Peacock) with niche audiences. If they can deliver a good customer experience - with structured ad breaks - and access to good clean room data, I suspect there’ll be quality inventory available for non-profits to build campaigns around. But if we see the fraud, intrusive formats and untargeted crap that characterizes the open web now, a great opportunity will have been missed for all parties.

Good Reads this Week

Viral Growth: How to Keep Lightning in the Bottle ⚡️

10 threads to summarize Auto GPT (AI that’s auto-coding and website building)

Visa partners with PayPal, Venmo and others to power interoperable digital payments

A Few Things I Believe About AI

Meta tests new ad offering in partnership with retail media networks

Amazon CEO Andy Jassy’s 2022 Letter to Shareholders

9 Useful Resources Generative AI

There’s always room for innovation and therefore much to learn from the Chinese dramas on WeChat - ultra short, low budget soap operas that have huge audiences.

Jobs and Opps

Charity Navigator: VP, MarComms

Environmental Defense Fund: Senior Director, Donor Engagement

Girls For Gender Equity: Chief Development and Marketing Officer

Human Rights First: Digital Director

M+R (Agency): VP, Advertising (Electoral & Advocacy)

IRC: Senior Director, Digital Engagement

Scratch Foundation: Head of Philanthropy

Thank you for reading Some Personal News

If you find this content valuable please share it.

How can I help you? I use my experience, expertise and network to help mission-driven organizations solve interesting problems and grow.