SPN. 139 Beyond Meta: Uncovering Hidden Opportunities

Plus, Audience Strategy > Media Strategy > Media Planning; and plenty of Jobs

A very warm welcome to all the new subscribers.

You’ve joined a community of 2k+ marketing and fund raising operators at mission-driven Org’s. I’m thrilled to have you as readers and truly appreciate your feedback and support.

Compliance is a BIG, hairy topic but it doesn’t have to scare the crap outta Org’s.

Nonprofits deserve great tech AND compliances just as much as any for-profit business!

That’s why Fundraise Up has poured a huge amount of resources into getting and maintaining so many different compliances globally.

They don't just "follow" ISO 27001 compliance practices, they’re independently certified as ISO 27001 compliant.

There’s a difference.

Game-changer? It is for me.

In this week’s SPN →

Are we missing a trick by over spending on some platforms?

Beyond Meta: Uncovering hidden opportunities

It’s time to diversify your spend

Audience Strategy > Media Strategy > Media Planning

and, plenty of Jobs & Opps that took my fancy this week.

Let’s jump in!

Uncovering Hidden Opportunities

Does anyone remember Mary Meeker, Queen of the internet, tech maven and famous for her data packed presentations - predicting the future?

Her work has had a huge influence on my thinking. Looking back one stat constantly got the headlines - the inbalance between share of time spent on mobile and share of ad spend on mobile. Her insight was that money follows eyeballs.

Which is why I got involved early in digital, then mobile then social and now AI.

Money follows audience and early movers get rewarded.

That seems a little quaint now - but I wonder if that data is worth reconsidering. There’s no doubt that mobile spend has been corrected but are we missing a trick by over-spending on some platforms? And under spending on others? The share of ad revenue for Meta would seem to be higher than the share of time spent.

A talk I saw this week reminded me that Pinterest has over 500m monthly active users and the impressive new results from Snap show they have 800m - with 445m daily active users. (Read their investor letter here). Spotify has 675m monthly actives and makes almost $2bn in ad revenue.

All huge audiences, driven by passionate user behavior.

Each a wonderful opportunity for Org’s looking to connect with donor’s - old and new.

But the attention they get is lower than they merit.

Right now the talk seems to be that these three might do well if TikTok were to close. But why don’t you look at how much you could take out of Meta now to fund smart partnerships with these platforms? Run your performance ads and explore the visual search Pinterest is pioneering.

Snap is doing well with direct response ads but also has the leading AR user base - what could you do with these new formats? Work on making audio ads as compelling as the music and talk that Spotify delivers.

Tangentially related, we should be thinking about the politics of advertising and use the craft skills of our teams to both make the arguments for a more diverse spend and to refute the siren calls of Musk and Twitter.

As ever it’s time to experiment.

Jobs & Opps 🛠️

If you have any jobs that you’d like me to profile please reply to this email.

UNICEF Canada: VP, Brand & Marketing ($128,000 - $165,000)

New York Presbyterian: VP, Development ($375,000 - $450,000)

American Heart Association: Digital Fundraising Manager, Liive ($75,000 - $80,000)

UNICEF: Digital Marketing Strategist (P2)

World Health Organization: Artificial Intelligence Specialist (Consultant)

Whitney Museum of American Art: Chief Communications & Content Officer ($225,000 - $300,000)

US Soccer Federation: Director, Content Strategy and Planning

Feeding America: Chief Information Officer ($300,000 - $350,000)

UNDP: Digital Transformation Specialist

Greenlight America: Communications & Digital Manager ($75,000 - $100,000)

USA for UNHCR: Director, Audience-Centric Engagement ($169,612 - $185,031)

Save the Children UK: Mid-Value Marketing Manager (£38,610 - £42,900)

→ More jobs updated daily to SPN’s sister website: www.pledgr.com

Audience Strategy > Media Strategy > Media Planning

More Orgs are hiring for audience-centric roles (great “Director, Audience-Centric Engagement” example from USA for UNHCR) – and I love it.

The definition of shady Principal Media practice (SPN #113) is to secure that Super Bowl ad - or, better yet, a high-impact media placement in The New York Times - and then slap it onto a media plan, claiming perfect alignment with the “45+ and Charitable” persona.

Digital fundraising – and broader direct response advertising – went all in on an audience-first approach a few years ago. People – and audiences – are the ones who click the “donate” button, so the change was inevitable, but Brand lagged behind.

After all, Media Planning has been the golden child of brand building (and most traditional media agencies) for years. If the brand shows up on the biggest networks and the creative looks like a Hollywood-produced movie, an Org’s brand equity and subsequent conversions must go up, right? Right!?

Not any longer. Audience Strategy trumps Media Strategy, which in turn trumps Media Planning across both Brand and Performance – full stop.

Let’s break each of these terms into what they mean – and a few action steps to take.

This order of operations ensures that the media your Org is running is selected based on what Audiences you are looking to expand into, not vice versa.

Step 1: Audience Strategy. Define the playing field.

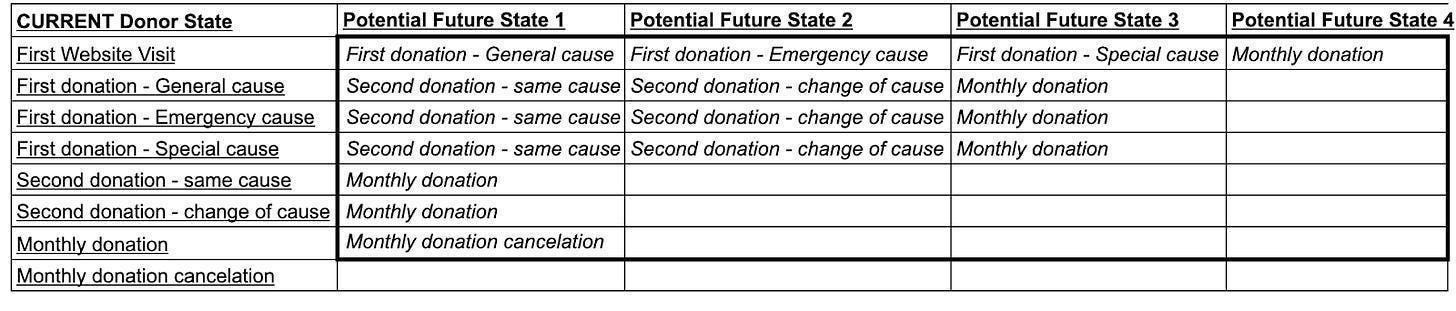

“45+ and Charitable” should be an inner circle joke among fund raisers and marketers. Audience strategy – who are the people to go after – is the first step that any Org needs to take while working on the media plan. Our good old Donor Lifecycle matrix first debuted in SPN #28 comes to the rescue:

→ Split your donation funnel into at least four steps – Prospects (those who never donated), One-Time Donors, Irregular Donors (those who donated more than once but didn’t subscribe for a monthly), and Monthly Donors. More steps are welcome based on your Org’s specific funnel.

→ Working right to left, distinguish at least five segments within each step. Using your web analytics tool and the previous year's data is perfectly fine. Definitions should be a combination of Demographics (age, less preferably gender since most devices other than mobile phones can be shared within a household) and Psychographics. If you’re using Google Analytics, it will already be modeled (in-market and affinity audiences). In any other tool, imply psychographics through page categories (e.g., “interested in nutrition”).

SPN Tip: For psychographics, define these segments through “NOT interested” as well. For example, “interested in nutrition and NOT interested in education”. This will be handy in the Media Strategy step.

The goal of this Step 1 is to have a table of 20 distinct segments:

→ Add more hypotheses to the Prospects row only – at least five more. Add here those wild brand-building ideas! The main rule is to keep these audiences incremental to the ones already in the table – ie, focus on the segments that don’t have any history with your Org. Maybe those are young donors, locations in which your Org doesn’t have a strong presence, or people who don’t seem interested in any of the causes you serve based on the online data.

→ Move the rest of the table up a row. Resulting audiences need to be - for example - “Current One-Time Donors (step) who look like the best Irregular Donors (segment)”. This ensures your Org’s audience strategy moves donors to the right in the lifecycle and, by design, excludes the worst performers. Keep the additional, incremental segments intact. The final table should look like this:

At this point, your Org has both audiences to advance - and new, incremental segments to expand into, satisfying both Brand and Performance needs.

Step 2: Media Strategy. Picking Horses for Courses.

The word “strategy” is vastly overused in the digital industry, frequently without a need or explanation. I define it simply as picking the media outlets that have an outsized reach of people I’m going after.

The two main rules I use to select channels are:

Pick channels where a combination audience is consistently present, and

Pick channels where buying technology is the best fit to achieve the goal.

To address #1, “target” each audience across various platforms to see potential reach. Most platforms provide this metric – set up a campaign and subsequently target each unique combination to trigger the estimation. A list I use that gives the broadest representation is:

Meta, as a proxy for both Facebook and Instagram

Google Ads, as a proxy for Display and YouTube

TikTok

LinkedIn

Some programmatic platform (DV360, TheTradeDesk, Amazon DSP, or any other)

SPN Tip: Also run the “inventory availability” report with the Website as a dimension in your programmatic ads platform of choice. This will help identify specific websites for each combination for potential direct deals.

For each Step x Segment combination, “eliminate” the bottom channel – the one with the least reach.

Addressing #2 - picking channels where buying technology is fit for the job - is also relatively straightforward and centered around the algorithms’ purpose.

To target incremental, new audiences to become prospects, you’re looking for the cheapest way to reach these segments with impactful creative. Strong AI models aren’t as important as reach and price -> eliminate Google and Meta from the mix and focus on social networks, video platforms, and programmatic ads.

To retarget current prospects to perform their first donation, proper timing of impression is key -> vice versa, lean into Google and Meta and their algorithmic campaigns (P Max and Advantage+).

To advance irregular donors to monthly, algorithms again play a less critical role, but impactful creative takes center stage -> lean into channels similar to the ones used for prospecting.

Step 3: Media Planning. Bring it to Life.

Once the Audience- and Media- “strategies” are defined, the media “plan” is nothing else than a testing matrix. Most Orgs wouldn’t have the budget to put the entire breadth of the media strategy they want to implement live simultaneously – a media plan helps address it.

Combine the previous two steps in one table – you should have ~60 “cells” (20 unique Step x Segment combinations, with ~3 channels for each)

Expand it further into other similar channels. Add Instagram, Snapchat, and Blue Sky to each cell where you have Facebook. Wherever you have YouTube, add Netflix, Spotify, and so on.

Break it further into creative concepts your team wants to test, targeting at least two variations for each cell.

Use some tactical variations, such as testing P Max versus classic GDA campaigns and “maximize conversions” versus “target ROAS” bidding strategies.

An example for “Current One-Time Donors looking like Segment #1 of Irregular Donors” testing five platforms, two creative variations, and a few tactical variations, would look like this:

Once your resulting media plan is up to ~250 rows, stop and assign a minimum budget per each. There’s no one correct number here – I use 1% of the monthly budget but not less than $1,000 as guidance. If your monthly budget is lower than $100k, reduce the number of rows used for the initial launch - assigning less than $1,000 will keep most platforms in learning mode for too long, delaying further optimizations. And if your budget is higher, don’t launch with more than 100 rows either - use the 1% of monthly budget per row rule.

After the initial launch, every month, stop 20 of the worst rows and launch the next 20 from the original plan. You’ll circulate through the entire media plan in ~6 months, leaving only the best 100 tactics at the end.

And after that, keep experimenting! More ideas will surface based on the patterns emerging – you will never run out of new ideas to test.

Weekly Reads

Currys’ TikTok videos deliver better ROI than paid advertising (The Drum)

Trump Tariffs Loom Over Ad Industry, From Brands to Digital Sellers (WSJ)

AI Voice update 2025 (VC A16Z)

No One Knows How to Price AI Tools (WSJ)

Meta’s investment in VR and smart glasses on track to top $100bn (FT)

Amazon MX Player Makes Major India Play With 100-Show Slate, Pushes Free Streaming (Variety)

Apple tops 1 billion subscriptions, nearly $100B in services revenue in 2024 (TechCrunch)

Ocado have added a clean room element to their retail media offering (Retail Times)

OK, that was a long one today!

I hope you’ve found one nugget today that you can put into play next week.

If you enjoyed this SPN, please consider sharing with your network. Thank you to those that do.

If a friend sent this to you, get the next edition of SPN by signing up below.

And huge thanks to this Quarter’s sponsor Fundraise Up for creating a new standard for online giving.